Inditab aims to provide B2B services to all the individuals (including Rural and Urban areas) who want to earn good income. Basically, Inditab is looking for business agents who can work for us and become a helping hand for People. Inditab is giving chance to people to integrate with them by having their own B2B Portal with their own name, logo and sell a wide range of Inditab services to their customers. Inditab provides secure and ready to use plug-ins that can be used to make personalized B2B portals. It is a great chance that you can have your own Portal and you can plug & play with all the services.

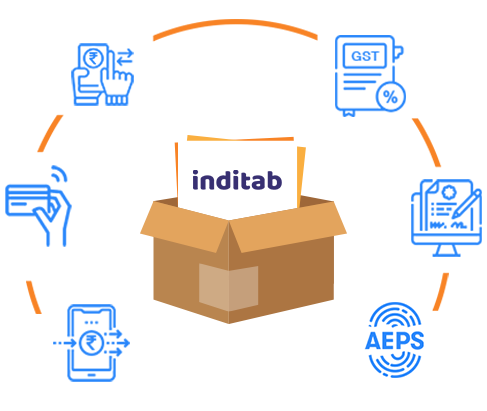

Inditab provides various services that include Prepaid Recharge and DTH, BBPS Bill Payments, Pan Agency, GST Suvidha Kendra, DSC Agency, Passport, MSME Registration, Pvt Ltd Company Registration, Partnership Firm Registration, LLP Registration, FSSAI Registration, Shop Establishment Certificate and many more.

All individuals who want to become Business Administrators for Inditab , can visit www.inditab.com , click on become an agent and leave his query over there and our Agent will contact you shortly.

10000+

25+

We are available 24*7 online. Our staff is completely supportive .Whenever and whatever query, You ask us we’ll reply within 24 hours. Excellent Customer Support on Call and email.

If your recharge is not successful or you are not satisfied with your payment or you want to cancel your payment then you can simply contact us, your amount will immediately refunded without being questioned.

Our Staff is completely supportive. You can either drop us a query at, support@inditab.com

We are into B2B services for many years. We invite business administrators to have agency of our various products and services and sell those services to people and in exchange of these services, we pay high commissions to our business agents.

This is assured that all transactions you process at www.inditab.com would lead to successful completion. There is only 1% probability that it got failed but Money would not be deducted, it would just show failed message.

We assure that all plans / details mentioned on our website www.inditab.com are 100% accurate. You will get details of all the plans on our website and they are 100% accurate and straight forward. They are clearly mentioned on our website, no confusion will be faced by customers.

Inditab Esolution Pvt Ltd is proud to have been recognized as an Indian startup across financial indices, for our brand value and for our reputation within and across the industries in which we operate. Our leadership is often acknowledged by leading financial publications, professional and government organizations, and other institutions around the India.

ISO Certified Organization 9001:2015

Startup India action plan (DPIIT), Govt of India

Recognized by Common Service Centre